Self employed payroll calculator

What the previous paragraph shows is that being self-employed is like being an employee but at a lower salary - lower by the FICA half that employers pay for their employees. For example you could be employed as a part-time shop assistant and run a business from your home.

Free Online Payroll Calculator Online Payroll Calculator Employee Payroll Calculator

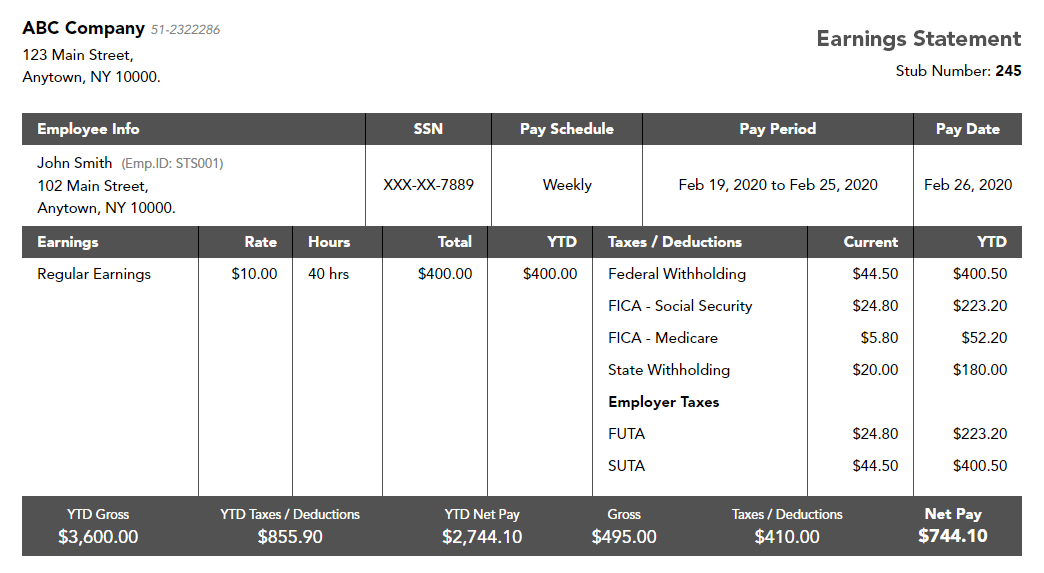

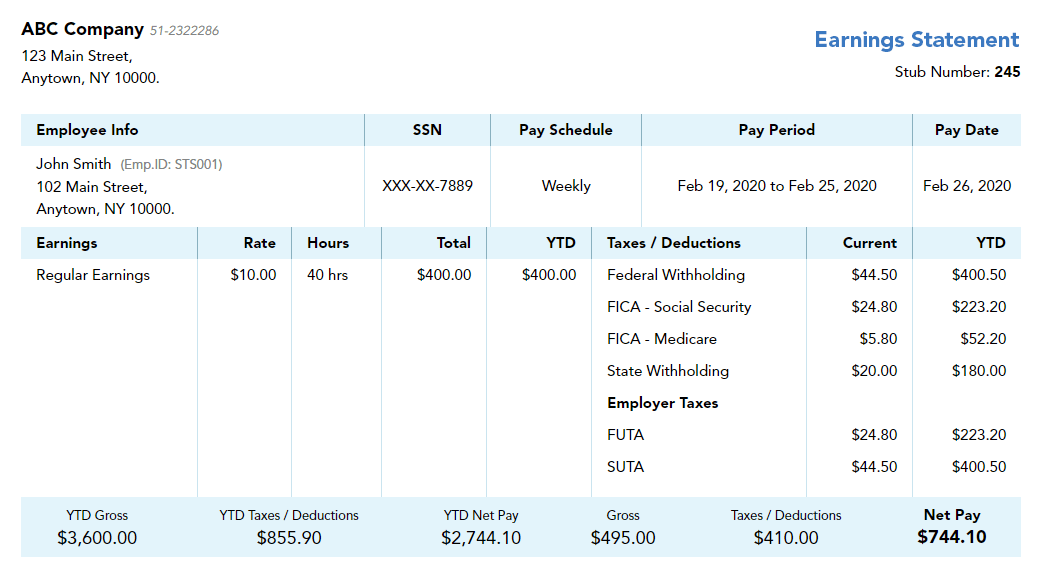

SECA established that self-employed individuals would be responsible to pay the whole 153 FICA.

. We know these are challenging times but you are not in this alone. Tell us that you are in business. QuickBooks Self-Employed is intended for freelancers contractors and consultants.

You dont have to wait until the end of the year to pay your taxes. I would have to pay employee payroll taxes on the 10k and she pays employer payroll taxes on the 10K. The rate for Medicare lands at 29.

Your account will automatically be charged on a monthly basis until you cancel. The program does the math for you and helps you figure out your estimated taxes so you can easily make the estimated tax deadline. While those on a payroll system will have their contributions taken automatically via PAYE self-employed people need to organise their own National Insurance payments through their self-assessment tax return.

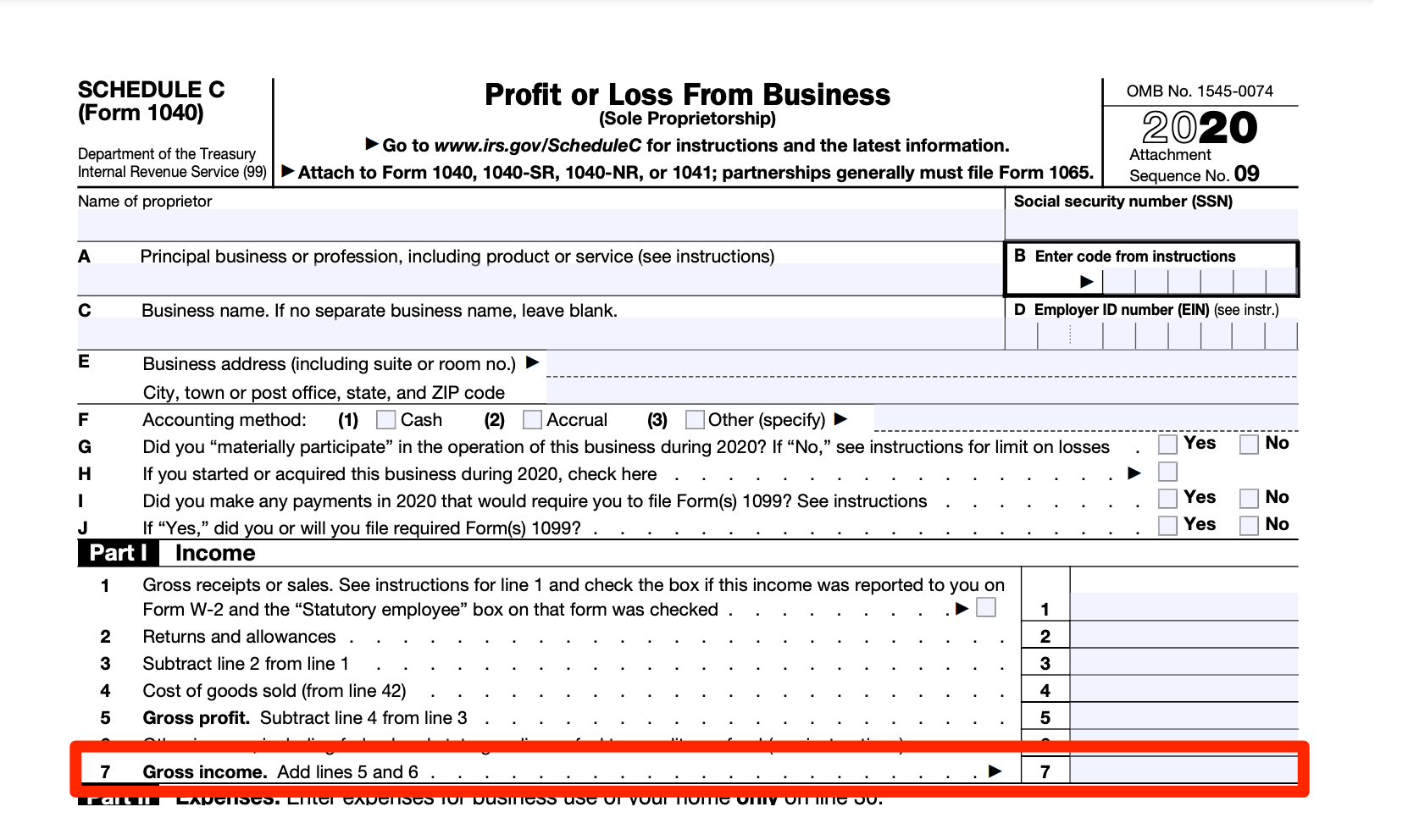

At the end of the year QuickBooks Self-Employed gives you the ability to export your Schedule C information from QuickBooks Self-Employed to TurboTax Self-Employed to make your annual tax filing easier. National Insurance contributions are paid by employees employers and self-employed people until they reach state pension age. The IRS imposes a 153 of self-employment tax on net earnings of self-employed people.

The second portion of your self-employment tax funds Medicare. Tax for self-employed people. Available in TurboTax Self-Employed and TurboTax Live Self-Employed.

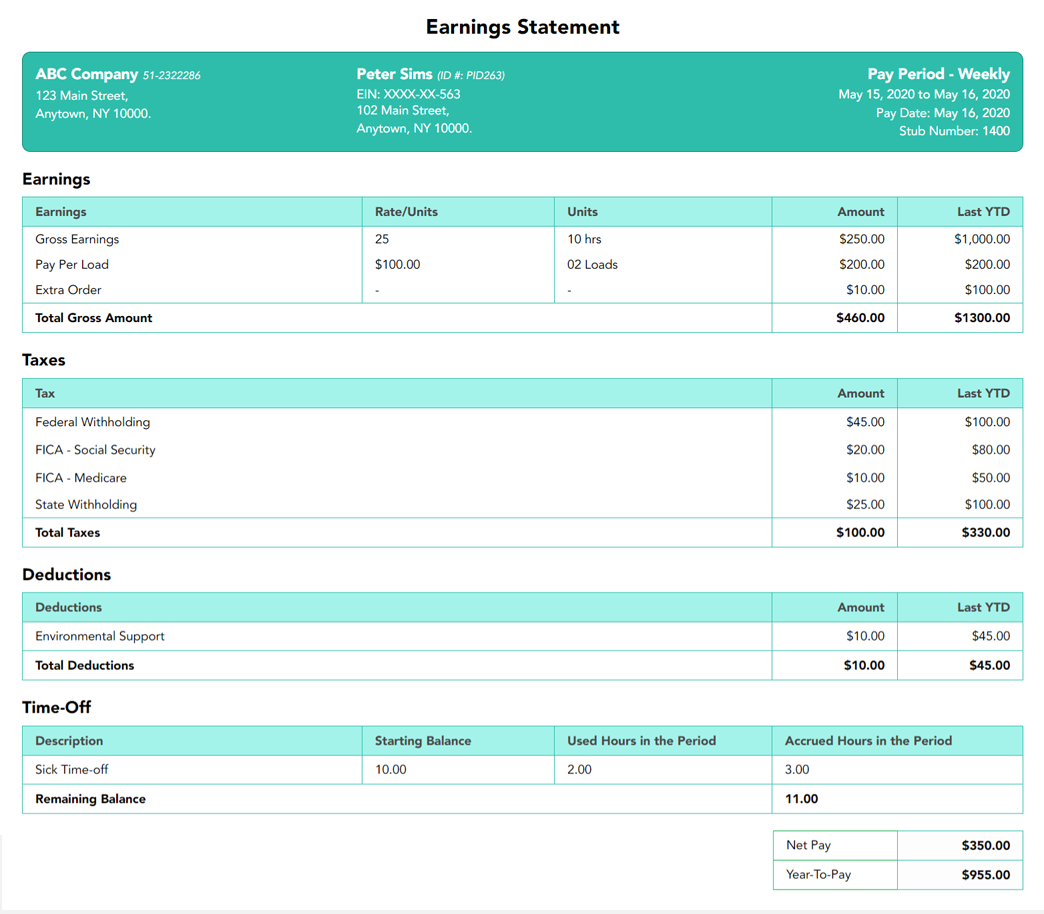

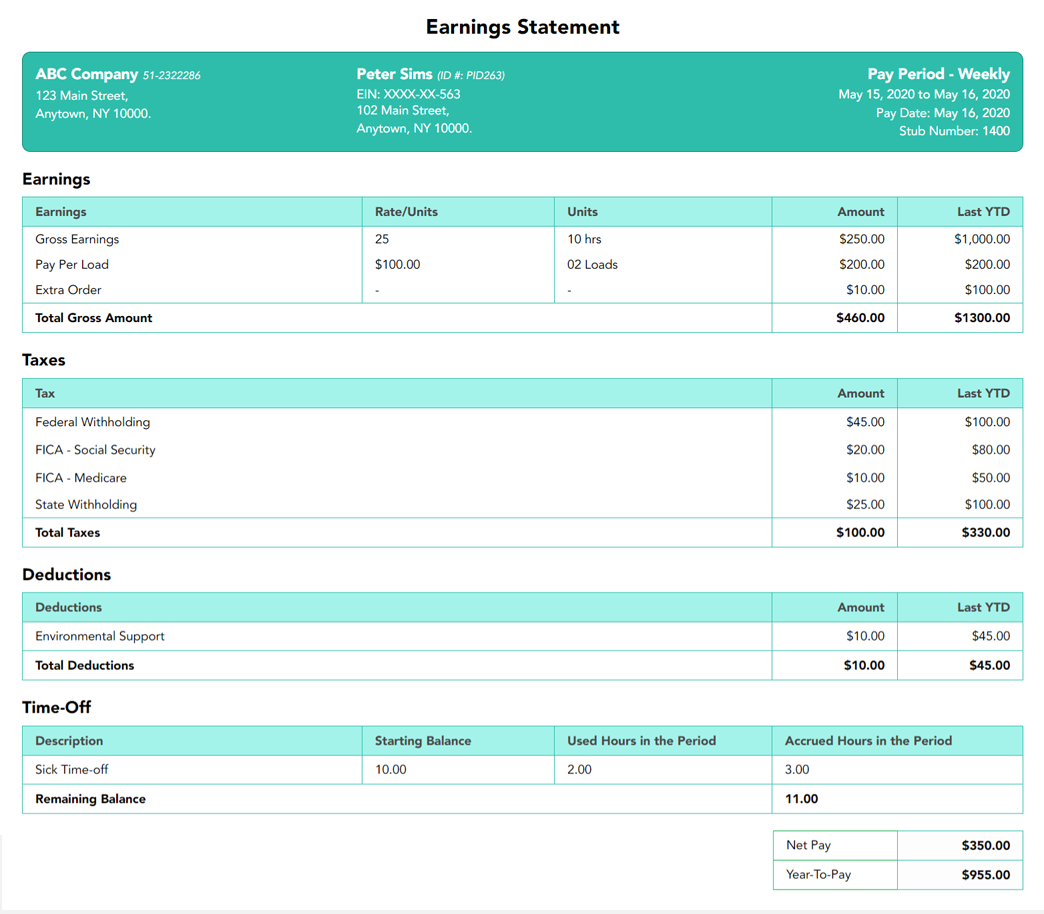

You cannot deduct self-employed vehicle expenses including. Let me clear up the Self-Employed Health Insurance Deduction a bit. Year to Date calculations You can add and customize the year to date YTD calculations while generating pay stubs with 123PayStubs.

To be eligible for this offer you must be a new QBSE customer. You can be employed and self-employed at the same time. This tax paid by self-employed individuals is known as the SECA or more simply the self-employment tax.

If the off-payroll working IR35 rules apply to a contract if HMRC will consider you as employed or self-employed for tax and National Insurance contributions purposes if you have or expect to. For either method keep a log of the miles you drive for your business. The interest rates for overpaid.

Year-Round Tax Estimator. Rewards good for up to 10 friends or 250 - see official terms and conditions for more details. ATAX is here to help with filing personal taxes bookkeeping payroll business taxes incorporations.

Our paystub generator is also a payroll tax calculator and an everyday payroll lifesaver trusted by many self-employed individuals. If you use the standard mileage rate you can only deduct the mileage at a standard rate. For 2021 the rate is 056.

30 Aug 2022 Credit and debit interest rate change on 30 August. This product feature is only available after you finish and file in a self-employed TurboTax product. Get up to date information tax advice and tools to help.

This means that you must. TurboTax is here to help you navigate the different coronavirus relief programs that you might be eligible for. Creating a Savings Plan.

12 Sep 2022 Changes to the rules for GST tax invoices. And so if youre self-employed you dont have to pay FICA on all your salary just on 9235 of it 9235 being 100 minus 765 - which is the contribution that your. Summary of the changes that came into effect on 30 March 2022.

If you are registered for Quebec Sales Tax QST and need to track QST andor require payroll QuickBooks Online Easy Start may be right for you. A 1099 tax calculator 2020 can help you ensure that youre using only the most current information and calculations. Discount available for the monthly price of QuickBooks Self-Employed QBSE is for the first 3 months of service starting from date of enrollment followed by the then-current fee for the service.

Both methods allow self-employed tax deductions for tolls and parking fees. Your net earnings are determined by subtracting your business deductions from business income. Many small business owners and self-employed individuals have been affected by Coronavirus COVID-19.

Use our Self Employed Calculator and Expense Estimator to find common self-employment tax deductions write-offs and business expenses for 1099 filers. And if youre marriedFuggedaboutit. May take it a step further and use that figure combined with the IRS Self-Employment Tax worksheet or some website calculator to.

Get ideas on common industry-specific business expenses people in your profession use. If you are self-employed you are responsible for your own tax.

Free Paystub Generator For Self Employed Individuals

Free Paystub Generator For Self Employed Individuals

Paycheck Calculator Take Home Pay Calculator

How Much Should I Save For 1099 Taxes Free Self Employment Calculator

How To Calculate Gross Income For The Ppp Bench Accounting

Self Employed Health Insurance Deduction Healthinsurance Org

Paycheck Calculator Take Home Pay Calculator

/calculate-your-selfemployed-salary.asp-ADD-V1-82a71e14d6d64f2b87f10d03a15a8fbb.jpg)

How To Calculate Your Self Employed Salary

Llc Tax Calculator Definitive Small Business Tax Estimator

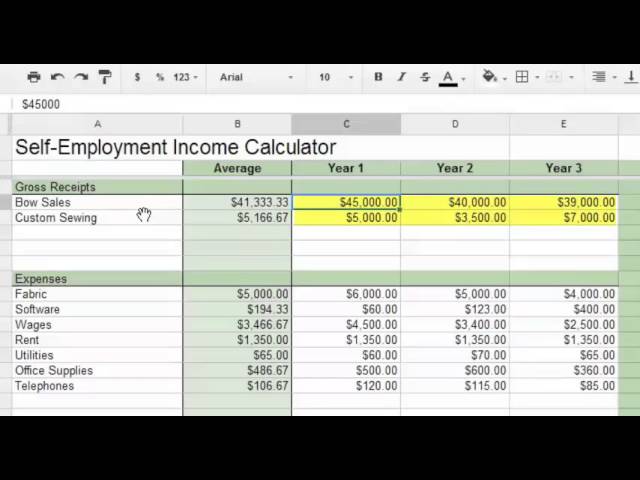

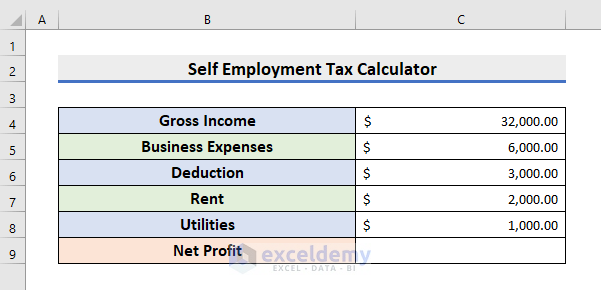

Self Employment Tax Calculator In Excel Spreadsheet Create With Easy Steps

Self Employment Calculator Youtube

Self Employment Tax Calculator To Calculate Medicare And Ss Taxes

Self Employment Tax Calculator In Excel Spreadsheet Create With Easy Steps

Free Self Employment Tax Calculator Shared Economy Tax

How Much Should I Save For 1099 Taxes Free Self Employment Calculator

Free Paystub Generator For Self Employed Individuals

Self Employment Calculator Youtube